Thank You for Supporting P.E.O.!

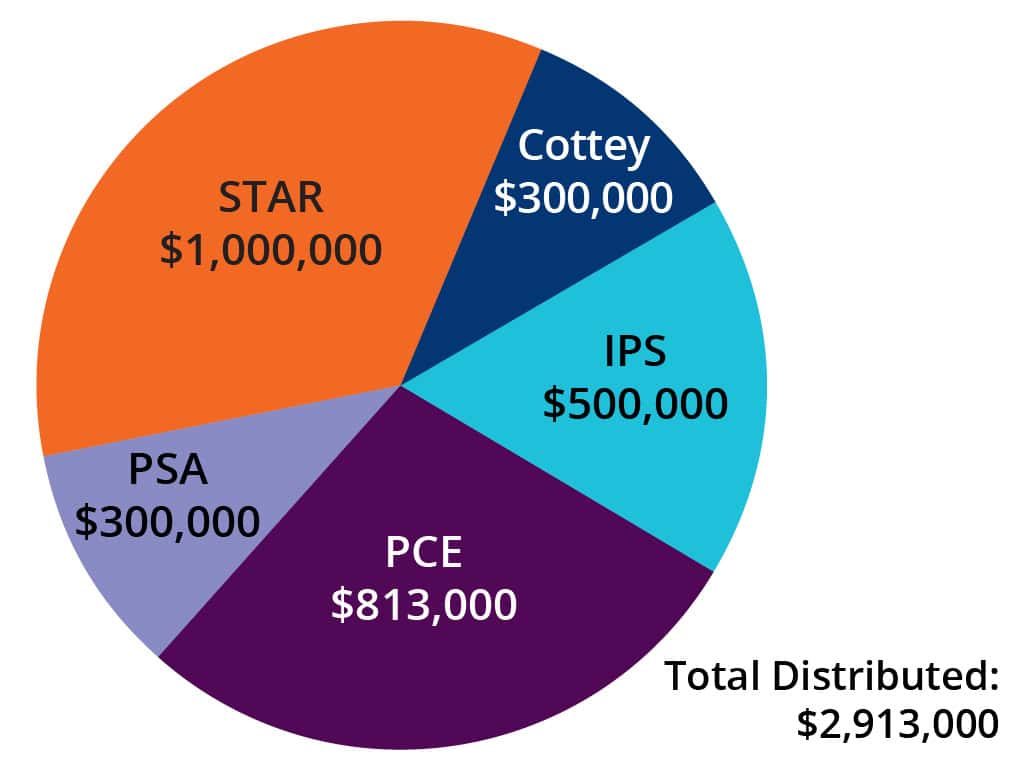

Every year, the P.E.O. Foundation trustees distribute money donated to the Undesignated Fund to each of the six P.E.O. projects. This money has a significant impact on the overall support P.E.O. can offer to help women reach their educational goals. In 2025, the annual impact distribution from the P.E.O. Foundation was over $2.9 million.

The P.E.O. Foundation trustees distribute these funds where they are most needed in that year. Due to the healthy balance available to provide loans in Educational Loan Fund, Undesignated funds were not allocated to the project this fiscal year.

How to Donate

At the heart of every donation is the realization of dreams and contributes to the P.E.O. mission of educating women.

Gifts may be made by cash, stocks, IRA donations, beneficiary of life insurance and/or IRA, estate plan, or will or trust. Cash gifts should be made by check payable to the P.E.O. Foundation; gifts of marketable securities should be transferred into the name of the P.E.O. Foundation. Email donations@peodsm.org for specific instructions.

Checks from individual donors (which are U.S. tax deductible) should be made payable to the P.E.O. Foundation, and sent to the P.E.O. Foundation, 3700 Grand Avenue, Des Moines, IA 50312.

Chapter checks are to be made payable to your state/provincial/district chapter, and mailed to your state/provincial/district chapter treasurer (or paid assistant). Please indicate P.E.O. Foundation or the specific fund on the memo line.

Types of Funds

The P.E.O. Foundation stands as a trusted channel for impactful giving. Every gift, no matter the size, is a gift to deserving women.

Individuals and chapters can establish a permanently endowed fund, named as the donor wishes, and is often established in the donor’s name or in the name of the one being honored or memorialized. Email fdn@peodsm.org with questions about setting up a fund.

Over 1,600 permanently endowed funds are currently held by the P.E.O. Foundation with four types of funds:

Transfer

Donors may establish a fund with the income automatically transferred annually, or accumulated until sufficient to pay a full award to one or more of the qualified educational and charitable projects of P.E.O.

Annual Impact Funds

Funds may be established for the benefit of the P.E.O. educational projects without the donor having to determine the exact distribution of income. The income from Annual Impact Funds is distributed to the P.E.O. educational projects annually by the P.E.O. Foundation Board of Trustees. As these funds do not designate a specific project, the income is distributed to the projects where it can have an impact that year providing additional funding where the need is greatest.

General Scholarship

Funds may be established for payment of a scholarship to a female student who has been chosen by your scholarship committee and may be paid to the recipient or to the school in which she is enrolled. No scholarship fund shall be established whereby the income is transferred to a school or other foundation for their selection of recipients.

Cottey College Scholarship

Funds may be established for payment of Cottey College scholarships. Scholarships will be paid directly to Cottey College for a student who has been chosen by your scholarship committee. If you wish for personnel at Cottey College to choose the recipient, then a transfer fund to Cottey College may be established for this purpose.

About the P.E.O. Foundation

The P.E.O. Foundation was established on October 4, 1961, to encourage tax-exempt gifts and bequests from individuals in order to benefit the growth of P.E.O. 's charitable and educational projects.

From humble beginnings of an initial $2,000 donation in 1961, the P.E.O. Foundation has grown to more than $145 million in assets from a combination of generous donations, gifts and bequests, and effective investing.

In 2025, the annual impact distribution from the P.E.O. Foundation was over $2.9 million. All was made possible by the loving generosity of the P.E.O. sisters and their families and friends.

Nuts & Bolts

Helpful Resources for More Information

Explore more information on establishing a fund, annual and planned giving options, or contacting the Foundation administration.

Establish a Fund in the P.E.O. Foundation

Fill out this online form if you are interested in establishing a fund in the P.E.O. Foundation

Annual and Planned Giving Options

Learn more about the benefits of giving and how to contribute.

Administration

The P.E.O. Foundation is administered by a board of trustees who are members of P.E.O. and are assisted by P.E.O. Executive Office personnel. Use the Contact Us form on our website to connect with someone who can help.